6 ways to pay in Singapore (tourist friendly)

When I first started visiting Singapore in 2001, payment was simple: Cash, and occasionally credit card if you were at a high end store or restaurant. These days, it’s a little more complicated than that; you can pay by cash, QR code, credit card, debit card, Apply Pay, Google Pay, and a wide variety of other apps. I put together this guide to help visitors to Singapore figure out which payment methods are best used in which circumstance, to help you prepare for your trip to Singapore.

In this guide to payment methods in Singapore I’ve included:

- Cash - where it is and isn’t accepted, and which ATMs are available

- Credit and Debit cards

- Apple Pay and Google Pay

- Prepaid travel cards, such as Youtrip, Revolut, and Wise

- QR codes and apps that can be used in Singapore by foreigners

- Local prepaid balance card (EZ Link)

1. Cash

Cash is widely accepted in Singapore. Some examples of where visitors can use cash in Singapore:

- Shops - department stores, souvenir shops, clothing and high-end fashion

- Eateries - restaurants, cafes, hawker centres

- Fun - massage shops, karaoke, pubs and bars

- Transport - taxis and buses

Cash is required when visiting a hawker centre, and for some brands of taxi. There are contactless payment methods available for these, but such methods are not typically available to short-term visitors to Singapore (i.e. if you don’t have a local bank account, it is difficult to use contactless payment at a hawker centre).

Some notable places that cash is not accepted include: Singapore tourist attractions (e.g. Bird Paradise, Zoo) and trains/MRT. The preferred payment method here is by Visa or Mastercard (I’ve included more detail in the Credit Cards section below).

Cash payments should be made using Singapore dollar notes or coins. While technically Brunei dollar notes are to be accepted by law, many shops are unfamiliar with them and may be reluctant to accept - I like to ask first before using Brunei dollars. Other foreign notes, such as US dollars, are not accepted in Singapore and should be exchanged at a money changer if you want to spend them.

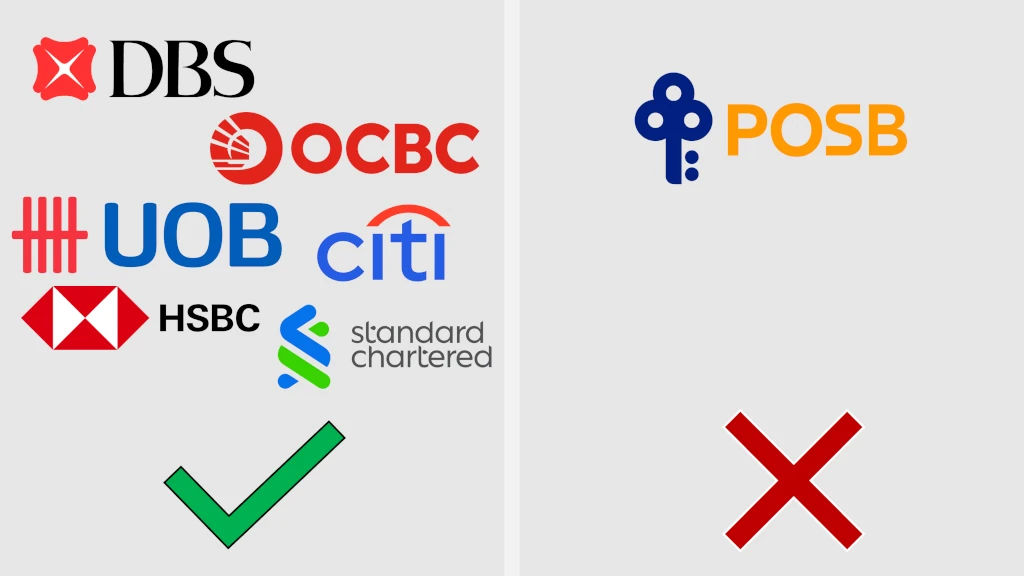

ATMs dispensing cash are widely available in Singapore. generally they can be found in MRT stations, shopping malls, and large hawker centres. The big banks providing ATMs suitable for foreigners include DBS, UOB, and OCBC. I’ve heard foreigners cannot use ATMs provided by POSB, but I’ve never tried this myself. ATMs typically dispense S$10 and S$50 notes, though some also dispense S$100 notes.

I’ve included more details on which ATMs can be used by major cards in the References section below. ATM fees depend on your bank and its agreement with banks in Singapore.

I usually recommend visitors carry S$50 to S$100 per person in their group when travelling around Singapore, especially if visiting a hawker centre or planning to order seafood (such as chilli crab). This is enough money to pay for small transactions - such as hawker food or taxi rides - while also being able to cover larger cash-only spends, such as seafood. Singapore is fairly safe, so I don’t find any problem carrying larger amounts of cash (except that it may be hard to spend all of it!).

2. Credit Card and Debit Card

Visa and Mastercard are widely accepted in Singapore. This includes both credit cand debit cards, as long as they operate on the Visa or Mastercard network, and that your home bank has permitted the card to be used in another country (many banks allow this by default).

Most shops, tourist attractions, restaurants, bars, and transport options accept credit card. An easy way I’ve found to tell if a restaurant will accept credit card is air conditioning - if the restaurant is air conditioned, chances are it will accept credit card (some non-air conditioned restaurants do as well, but these are less common).

American Express is also accepted in Singapore, though I’ve found it not as widely accepted as Visa or Mastercard. Amex can’t be used on public transport for example. Usually the larger restaurants, shops, and tourist attractions will accept American Express.

Diners and JCB can be used in Singapore, though they have smaller footprints again. I’ve never seen Discover cards accepted in Singapore (though they can be used in ATMs - see the References section for more detail).

Buses and trains (MRT) accept foreign credit and debit cards that use the Visa or Mastercard networks. You tap the card on when you enter the bus / train station, then tap again as you exit. A 60 cent per day charge is added when using a foreign card, regardless of how many trips you take in that day. I wrote a full guide to bus and train payments here: reachingsingapore.com/singapore-train-cost

Most taxis accept credit card payments, though a 10% administrative charge is added to the fare. As some taxis do not accept credit card, it is best to confirm with the driver that card payment is available before starting the ride.

3. Apple Pay and Google Pay

Apple Pay and Google Pay are really popular in Singapore. A lot of locals use these to make contactless payments at shops (particularly convenience stores) and on public transport.

For visitors, this means Apple Pay and Google Pay are widely available in Singapore. Contactless payments for Visa, Mastercard, and American Express are usually available wherever these cards are accepted, meaning that Apple Pay and Google Pay used in conjunction with these cards should work for foreigners visiting Singapore.

Some exceptions I’ve found are at restaurants. Occasionally the restaurant payment terminal is too old to support contactless payment (including Apple Pay and Google Pay). This is becoming less common though, most restaurants that accept credit card payment can take contactless payment.

4. Prepaid Travel Cards

Prepaid travel cards - such as YouTrip, Revolut, and Wise - generally work in Singapore.

These prepaid travel cards allow you to load a set amount of your home currency onto the card and then either covert it on-the-fly (when you spend) or convert a fixed balance in advance to be spent.

As these prepaid services tend to use the Visa or MasterCard network for payment processing, they work widely in Singapore - including for use on public transport. Personally I’ve only tried a Wise UK card, and it worked on the MRT in Singapore. My family used YouTrip and it seemed to work well too.

5. QR Codes

Cross-border QR code payments are now available in Singapore to visitors coming from the following countries:

- Malaysia - using DuitNow

- Thailand - using PromptPay

- Indonesia - using apps that support QRIS

These QR code systems are accepted as they would be at home - simply scan the Singapore PayNow QR code to pay.

It won’t work with personal QR codes (yet) - sometimes in Singapore merchants will use their personal QR codes for payment, and at the time of writing these are not supported.

AliPay and WeChat QR codes can also be found in Singapore, though generally more likely in places that Chinese tourists frequent.

6. Prepaid EZ Link Card

When I first started visiting Singapore there used to be prepaid contactless cards that you could use for small purchases and public transport rides (I imagine this was to rival Octopus in Hong Kong). While most of these have fallen out of use, the prepaid EZ Link card has survived.

Prepaid EZ Link cards are predominantly used for public transport rides, but many shops also accept them for small payments. The most common example I can think of here is 7-Eleven and other convenience stores that accept EZ Link for payment. Some larger shops, as well as taxis, also accept EZ Link.

I’ve found the best use for tourists here is to avoid a pile of coins building up from numerous small purchases at convenience stores. Unfortunately EZ LInk isn’t often accepted at hawker centres (the other main source of coins in my pocket).

EZ Link can be purchased at MRT ticket offices and 7-Eleven. It costs S$10 and comes with an S$5 balance. Credit can be added to the card at the same locations.

The Singapore Tourist Pass is technically an EZ Link card and can be used for purchases. The card does not come with any balance (the “Unlimited rides” is not part of the balance) so needs to be topped up before spending. I’ve never tried to top it up while on the “Unlimited rides” period so not sure how this works.

References and Further Reading

I’ve included in this section the ATM locators for each of the major networks, as well as other websites you might be interested in for further researching your trip to Singapore.

ATM Locators

American Express uses DBS ATMs in Singapore, the ATM locator can be found here: https://network.americanexpress.com/globalnetwork/atm_locator/en/#search

Discover also uses DBS ATMs in Singapore, the Discover ATM locator can be found here: https://www.discover.com/cash-atm-locator/

Visa has a wide array of ATMs available, including DBS, OCBC, and UOB; their ATM locator can be found here: https://www.visa.com/locator/atm

MasterCard also has a wide array of ATMs available, their ATM locator can be found here: https://www.mastercard.us/en-us/personal/get-support/find-nearest-atm.html